Home Prices Across America

Median home prices can help home buyers understand typical home costs in their geographic area. The metric indicates that half of the homes in a specific country, state or even ZIP code sold for more than that price, and half sold for less. Combined with mortgage rates and other factors, median home prices by state provide valuable insight into home affordability and can make it easier to choose a location that fits your budget.

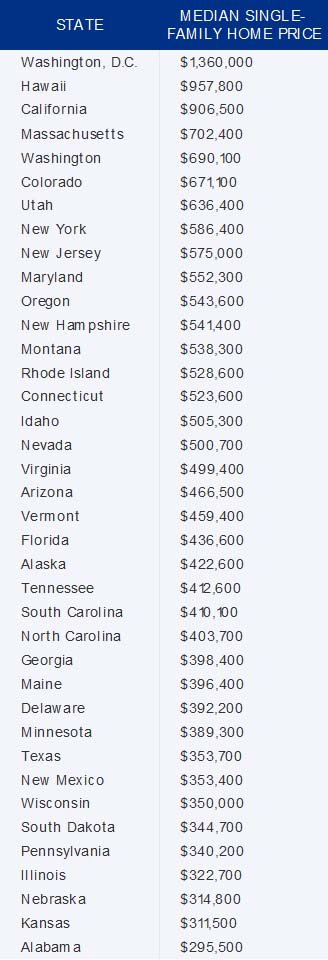

We reviewed real estate company Redfin’s monthly housing data for single-family homes to identify the lowest and highest median home prices in the country. Whether you’re shopping for a home locally or planning a move, we’ll show you what to expect in each state, plus some tips for saving money when you buy a house.

Median Home Price in the U.S. in 2025: $462,206

The U.S. median home price for single-family homes was $462,206 in May 2025, according to data from Redfin. This represents a 0.5% increase over last year, in spite of there being 15.1% more single-family homes on the market than in May 2024. The median sale price for all home types was lower at $440,913, which accounts for the lower cost of condos and town houses in many areas.

Despite fluctuations throughout the year, 30-year mortgage rates decreased from 7.03% on May 30, 2024, to 6.89% on May 29, 2025, making monthly payments slightly less expensive for those looking to buy a home.

Median Housing Costs by State

While median home prices represent the middle value of homes sold within a specific area, median housing costs go beyond purchase prices to reflect the total monthly costs of owning or renting a home. Housing costs usually include mortgage or rent payments, property taxes, insurance, utilities and other monthly housing expenses.

The median home price focuses solely on the upfront cost of buying property, but median housing costs can help you budget by providing a more comprehensive picture of the financial commitment required to rent or own in a certain state.

States With the Highest Median Home Prices

Factors like supply and demand, strong job markets, desirable climates and proximity to amenities often translate to higher median house prices. So, what state has the highest median home price? Though not a state, Washington, D.C. has a median home price of $1,360,000, while Hawaii leads U.S. states with a median price of $957,800. Here’s how the top markets stack up:

- Washington, D.C. The District of Columbia isn’t technically a state, but this popular area boasts the highest median home sale price in the country at $1,360,000. This high-priced market puts it in contention with cities like Los Angeles and New York City for the priciest cities to buy a house. Low supply and high demand drive up single-family housing costs, though condos are less expensive, with a $479,500 median sale price.

- Hawaii. With a median sale price of $957,800, real estate prices in the Aloha State are more than twice Redfin’s national median. Housing costs and the overall cost of living are driven by factors like limited land, high construction costs and tourism demand.

- California. California is well known for its pricey real estate, especially in high-profile cities like Los Angeles and San Francisco. At $906,500, California’s median home price is more than $200,000 higher than the next most expensive state, Massachusetts. In addition to high demand, California’s high costs are due to strict zoning requirements, high development fees and lengthy permitting processes.

- Massachusetts. Massachusetts is known in New England for its economic and educational offerings and high home prices, with a median sale price of $702,400. Supply-and-demand issues drive high prices in popular areas like Boston, but costs are also high due to historical preservation efforts and other factors.

- Washington. Just a bit less than Massachusetts, the median home price in Washington is $690,100. Not only is the state home to competitive markets like Seattle and Tacoma, but Washington’s high median home price is largely due to its thriving tech industry and appealing waterfront real estate.

Manhattan and Brooklyn are an interesting microcosm of regional contrasts. Tighter discounts in Manhattan (down to discounts of 4.4%, an 8.3% year-over-year drop) and shorter time on market (-7.6% to 85 days) suggest buyers are returning with purpose, albeit selectively. In Brooklyn, discounts widened by over 15% (up to 3% discounts) and days on market ticked up slightly (up to 58 days), hinting that buyers there may be regaining leverage, although the low discount suggests sellers still have some sway.

This mirrors broader regional patterns: mature markets, such as the Northeast, are experiencing price stability with fewer concessions, while previously high-growth regions appear to be struggling with rising inventory and stagnant sales.

States With the Lowest Median Home Prices

Just as some markets fetch higher home prices, some states have lower median home prices due to limited job opportunities, low demand, less restrictive zoning regulations and other factors. How much is a house in a more affordable area? Here’s what to expect in states with the lowest median home prices:

- West Virginia. The lowest median home sale price, according to Redfin data, belongs to West Virginia at $253,100—close to half of Redfin’s national median and more than $1 million less than Washington, D.C. Surprisingly, the median sale price of condos in May 2025 was higher than for single-family homes, at $263,500. This may be due to higher demand for location, newer construction, modern amenities and other appealing features.

- Iowa. Iowa housing is accessible due to its stable real estate market and low cost of living. The median sale price for single-family homes in the state was $255,200. As in West Virginia, the median condo price was higher—$274,000—over the same period.

- Oklahoma. Oklahoma offers rural and city living with single-family homes selling for a median price of $260,400 statewide. Homes were more expensive in Oklahoma City, where the median price was $279,500, but more affordable in Tulsa, where the median sale price was $250,000 over the same period.

- Louisiana. Louisiana’s median home sale price was $263,200, likely due to the state’s low construction costs and inexpensive, plentiful land. It’s also not a popular tourist destination, with the exception of New Orleans, where the impact of short-term vacation rentals on local communities has been a major point of contention.

- Mississippi. The median sale price of a single-family home in Mississippi is $264,900, with home prices up almost 3% compared to last year. That said, demand is slightly down year over year, with fewer houses selling above list price.

- Florida. The median price for a single-family home is $463,600, but this is slightly misleading since there are many wealthy people are investing in luxury homes and making Florida their primary residence. Florida is one of only 7 states with no income tax and many of the counties have very favorable property tax structures.

- Why Move To Florida

- The Weather

- The Price of homes

- Reasonable Property Taxes

- No State Income Tax

Bottom Line

Three interlocking forces are shaping the housing market in 2025: mortgage rates, macroeconomic uncertainty and lingering inflation. First, mortgage rate lock-in remains a stubborn drag on inventory. With many homeowners sitting on 3% mortgages, many are simply unwilling to trade up, down or sideways into a 6.5% world.

In terms of macroeconomics, uncertainty, driven by news of tariffs, market swings and geopolitics, tends to make buyers more cautious. This can lead to a standstill for sellers who list with high aspirations and can serve to widen discounts as closing prices bend to reality.

While this shows the median price of homes per state, every state has local geographic real estate markets that tend to be higher or lower than the state median home price. Even Florida has areas where the home prices are lower than some of the least expensive areas in America. And likewise, Florida has some of the most expensive real estate in the US.

Lastly, inflation, while off its peak, continues to reshape affordability. Higher costs of living, from groceries to insurance, are reducing what buyers can comfortably spend on housing.

For more information about Collier County Florida Real Estate, go to Rick Huggins Real Estate Naples Florida