What Is the Best Mortgage Interest Rate to Buy a Personal Residence?

What Is the Best Mortgage Interest Rate to Buy a Personal Residence?

When buying a personal residence, one of the most common questions homebuyers ask is, “What is the best mortgage interest rate?”

The short answer is—it depends. The “best” rate isn’t a single number; it’s the lowest rate you personally qualify for, based on several key factors.

What Is Considered a “Good” Mortgage Rate?

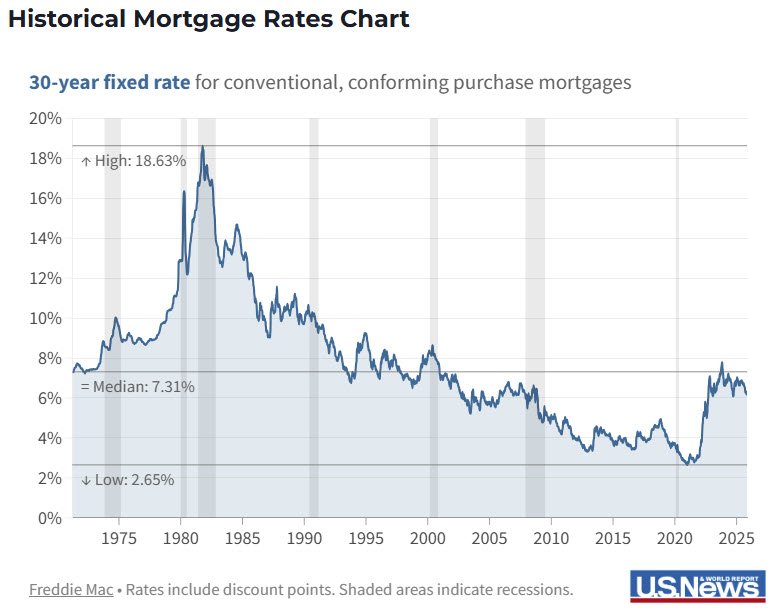

Mortgage rates change daily in response to market conditions such as inflation, Federal Reserve policy, and bond market activity. In general, a good rate is one that is competitive for the current market and appropriate for your financial profile.

It’s also important to understand that your total monthly housing payment includes more than just principal and interest. Property taxes, homeowners insurance, mortgage insurance (PMI), and other costs can often have a greater impact on your monthly payment than small fluctuations in the interest rate.

For example, on a 30-year fixed-rate loan, the payment typically changes by about $15 per month for every $100,000 borrowed for each ¼-point difference in rate. By waiting for a minor rate decrease, changes in taxes or insurance alone may outweigh any savings from the lower rate.

Rather than focusing on national averages, buyers should compare:

- Rates offered by multiple lenders

- The loan type (conventional, FHA, VA, jumbo)

- Points and lender fees associated with the rate

In many cases, a slightly higher interest rate paired with lower fees can result in a better overall financial outcome.

Factors That Determine Your Mortgage Interest Rate

Several personal and financial factors influence the rate you’re offered:

- Credit Score

Borrowers with higher credit scores generally qualify for lower interest rates. Even modest improvements in your score can result in significant savings over the life of the loan. - Down Payment

Larger down payments reduce lender risk and often lead to more favorable rates. Conventional loans with 20% down typically offer the best terms. - Loan Type and Term

- 30-year fixed loans provide long-term stability but slightly higher rates

- 15-year fixed loans usually carry lower rates but higher monthly payments

- Adjustable-rate mortgages (ARMs) may offer lower initial rates but can increase over time

- Debt-to-Income Ratio (DTI)

A lower ratio of monthly debt to income strengthens your financial profile and can help you secure better loan terms. - Primary Residence vs. Investment Property

Primary residences generally qualify for lower interest rates than second homes or investment properties.

How to Get the Best Rate Possible

To improve your chances of securing the best available mortgage rate:

- Get pre-approved before beginning your home search

- Compare loan estimates from multiple lenders

- Consider locking your rate when market conditions are favorable

- Avoid major financial changes before closing, such as new loans or large purchases

Should You Buy Now or Wait for Rates to Drop?

Many buyers attempt to time the market, but interest rates are unpredictable. If you find the right home and the monthly payment fits your budget, buying now can make sense—especially since refinancing may be an option if rates decline in the future.

While mortgage rates may fluctuate, home values tend to rise over time. Waiting for a small rate decrease could mean missing out on home appreciation and facing higher prices or increased competition, particularly in desirable markets like Southwest Florida.

If you’re currently renting and expect to remain in the same job and area for the foreseeable future, buying is often a better long-term financial decision than renting. There are loan programs available for a wide range of circumstances, including low or no down payment options and flexible qualification guidelines.

The Bottom Line

The best mortgage interest rate is the one that aligns with your financial situation and long-term goals—not simply the lowest rate advertised. Working with an experienced real estate professional and a trusted local lender can help you evaluate your options and make informed, confident decisions.

If you’re considering buying a home and would like guidance on current market conditions, financing strategies, or neighborhood trends, feel free to reach out. Making the right decision today can save you thousands over time.